How Restaurant Franchise Brands Outperform Facebook Benchmarks with Local Advertising

Restaurants rely on consistent foot traffic and repeat customers to thrive, but national campaigns often fail to capture local dining trends, special events, or seasonal promotions. For franchises and multi-location restaurant brands, reaching the right audience at the right time is critical to driving reservations, takeout orders, and in-store visits.

With Tiger Pistol’s localized advertising approach, restaurant brands can deploy hyper-targeted campaigns that deliver stronger engagement and cost efficiencies. Restaurants using Tiger Pistol’s platform achieve:

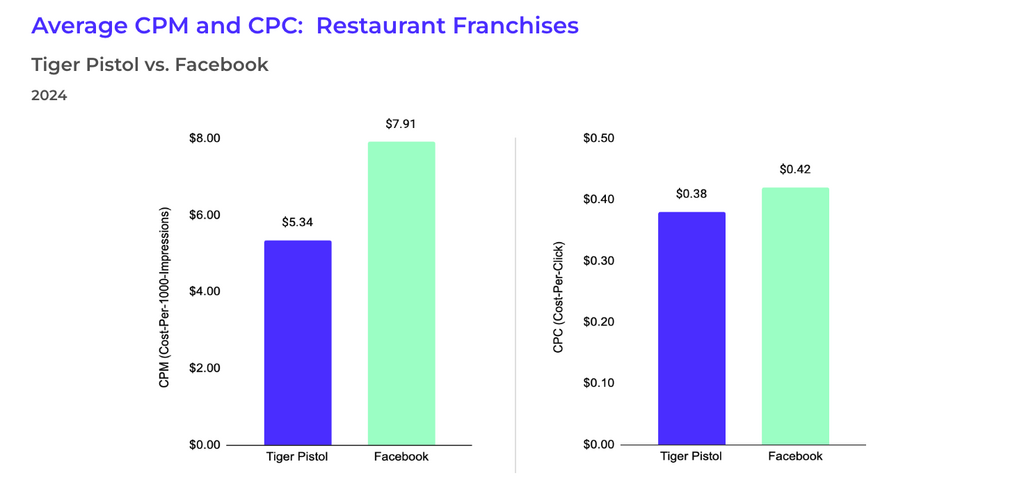

- 39% lower CPM than Facebook, making brand awareness campaigns more affordable.

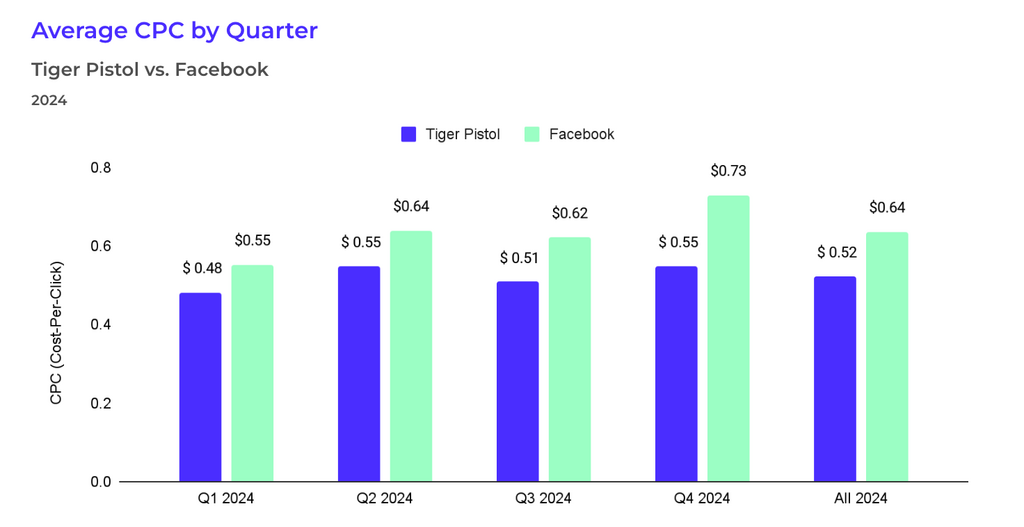

- 10% lower CPC, helping restaurants drive more website visits, reservations, and orders.

By focusing on locality, restaurants can engage diners with relevant messaging, special offers, and promotions tailored to their specific markets. Whether promoting a lunch special, a new seasonal menu, or a loyalty program, localized advertising ensures restaurant brands stand out in a crowded digital space and remain top-of-mind for local diners.

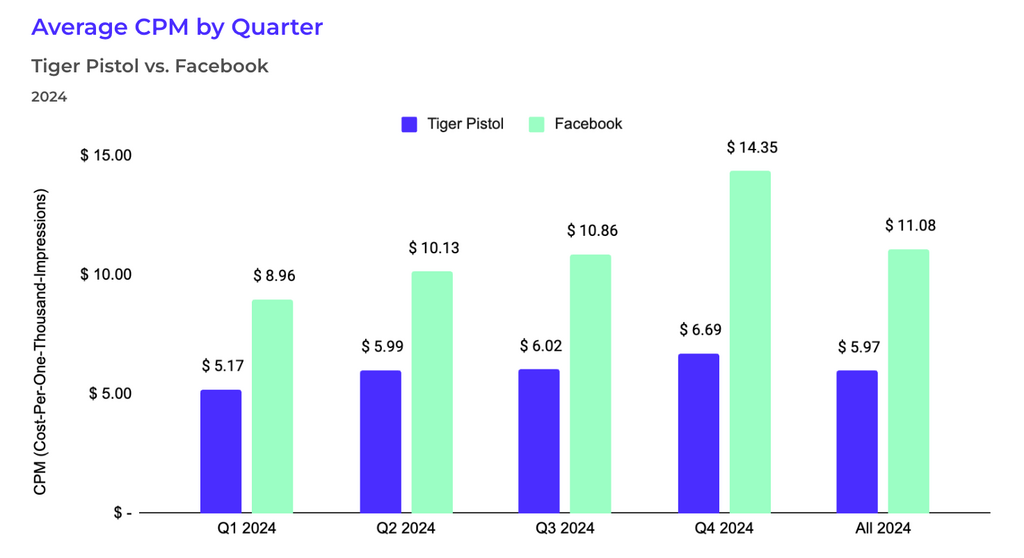

Across all industries, Tiger Pistol’s local advertising platform consistently delivers more cost-effective results than Facebook’s benchmarks. Even during peak advertising seasons like Q4, Tiger Pistol ensures cost stability, with only a 10.5% increase in CPM compared to Facebook’s 28% surge.

Tiger Pistol’s localized approach to social advertising consistently outperforms Facebook’s Business Manager by improving efficiency and engagement while lowering costs.

For franchise and multi-location restaurants, scalable local advertising is the key to sustainable growth. By running ads from local business pages rather than a national brand account, restaurants build credibility, drive more direct engagement, and ensure promotions are relevant to each market. Tiger Pistol’s platform empowers brands to maintain centralized control while giving individual locations the flexibility to promote menu items, events, and offers that resonate with their local customer base. With a localized strategy, restaurant brands can fuel consistent foot traffic, increase orders, and strengthen long-term customer loyalty.

Learn how Wendy’s streamlined franchisee social campaign management – centralizing control while unifying data across regions

Learn how Ben & Jerry’s boosted delivery orders with location-targeted, Uber-Eats coupon campaigns – turning local ads into real sales.

Discover how Tiger Pistol can power your local advertising success.

Related Posts

Winning the Eatertainment Game with Low Cost, High Engagement Local Social Advertising

Eatertainment – a concept blending dining with activities like mini-golf, bowling, or axe-throwing – offers a unique experience that keeps guests engaged and spending more. As this industry continues to grow, local social advertising emerges as a crucial tool for driving traffic and increasing average order value. By leveraging platforms like Facebo

How Localized Advertising Fuels Franchise Growth and Strengthens Franchisee Trust

Trust is the foundation of every successful franchise relationship. It shapes franchisees’ perception of the brand, influences their willingness to embrace corporate initiatives, and ultimately drives their performance. However, fostering trust in a franchise system requires more than just strong branding – it demands consistent communication, transpare

Engaging Home Services Consumers: Strategic Use of Facebook, Instagram, TikTok, and Amazon

Millennials are redefining how home repairs are approached, with many opting to hire professionals over tackling tasks themselves. For example, only 20% of millennial homeowners feel confident repairing drywall or installing a ceiling fan, and just 31% are comfortable attempting exterior painting or light installations. Surprisingly, nearly one-third (30%) of m

The Triple-Threat: How the Rule of Three Significantly Reduces Facebook and Instagram Advertising Costs

Aristotle suggested it first: “omne trium perfectum” – Latin for “Three is Perfect.” We marketers refined it to create stickier slogans – “Just Do It,” and more persuasive messaging – “Skin care that hydrates, clears, and brightens.” Good things come in threes. Applying the rule of three to Facebook and Instagram by prioritizin